What Is an FDI Strategy? Meaning, Types & Nepal Guide

As businesses grow, staying in only one country can slow them down. Local markets can get crowded, costs can rise, and opportunities for growth may become limited. To reach new customers, lower costs, or access important resources, companies often look beyond their home country. One of the most trusted ways to do this is through Foreign Direct Investment (FDI).

Here is a simple way to understand it:

- FDI is like buying a bus. You own it, run it, hire the driver, and choose where it goes. You are responsible for profits, losses, and daily work.

- FPI is like buying a bus ticket. You are just a passenger. You may enjoy the ride, but you do not control where the bus goes or how it is run.

Because FDI involves ownership, control, and long-term risk, companies need a clear FDI strategy. Without proper planning, even a market that looks attractive can become risky and expensive.

What Is Foreign Direct Investment (FDI)?

Foreign Direct Investment (FDI) is when a person or company from another country puts money into a business or project in a different country for a long time. They also get to make decisions and help manage the business.

FDI usually includes:

- Ownership or control of a business

- Being involved in how the business is run every day

- Staying committed to the country for a long time

For example, when a foreign company builds a factory, starts another branch, or works with a Nepali company to run the business, it is called FDI. Unlike short-term investing, FDI focuses on creating a strong and lasting business in the country.

Recommended Read: How can FDI Impact Business Growth in Nepal?

FDI vs Foreign Portfolio Investment (FPI)

This table provides a clear comparison between FDI and FPI:

| Basis of Comparison | Foreign Direct Investment (FDI) | Foreign Portfolio Investment (FPI) |

|---|---|---|

| Meaning | Investment in a foreign business with ownership and control | Investment in financial assets without control |

| Level of Control | High control over management and decisions | No control over business operations |

| Nature of Investment | Active involvement in operations | Passive financial investment |

| Time Horizon | Long-term commitment | Short-term or medium-term |

| Risk Level | Higher due to operational exposure | Lower, linked mainly to market movements |

| Return Type | Stable, long-term business returns | Market-driven financial returns |

| Example | Setting up a factory or subsidiary | Buying shares or bonds |

FDI Strategy Meaning

An FDI strategy is a planned approach that helps a company decide how to enter, run, and grow a business in another country. It helps businesses choose where to invest, how much to invest, and how much control they want to keep.

A strong foreign direct investment strategy connects:

- Capital investment decisions

- Level of ownership and control

- Risk management plans

- Long-term business goals

With a clear strategy, investors can avoid legal problems, cultural issues, and unexpected financial losses.

If you are looking for FDI service in Nepal, Milan Khatiwoda provides the best service for your business.

Objectives of an FDI Strategy

The objectives of an FDI strategy explain why a company chooses to invest in another country. These goals help investors align their capital, operations, and long-term plans with the right market opportunities.

The main objectives of an FDI strategy are:

- Market expansion: Enter new geographic markets to reach more customers, increase sales, and reduce dependence on a single domestic market.

- Access to resources and skills: Gain access to natural resources, raw materials, technology, or skilled labour that may be limited or costly in the home country.

- Cost efficiency: Reduce production, labour, or operational costs by investing in countries with competitive cost structures.

- Competitive advantage: Strengthen market position by producing closer to customers, improving supply chains, or benefiting from local incentives.

- Risk diversification: Spread business risk across multiple countries to reduce the impact of economic or political changes in one market.

Types of Foreign Direct Investment (FDI)

Foreign Direct Investment (FDI) can happen in different ways depending on what a company wants, how much control it needs, and what the market looks like.

Some companies grow the work they already do, while others focus on supply chains or selling in other countries. Knowing these types helps investors pick the right plan and handle risks better.

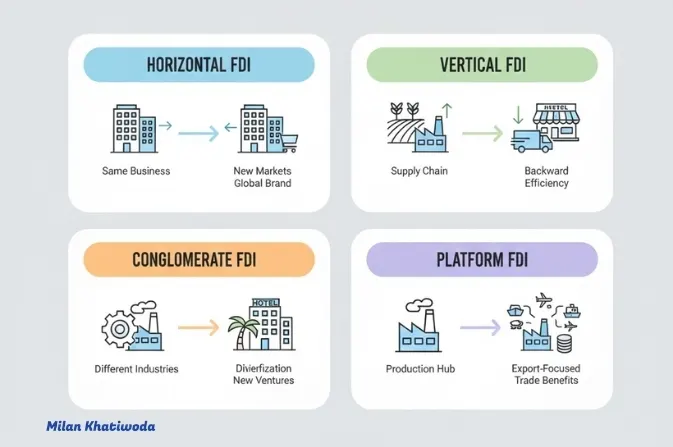

Horizontal FDI

Horizontal FDI is when a company invests in the same type of business in another country as it already does in its home country. The company does not change what it sells or how it works. The main goal is to enter a new market, reach more customers, and grow its name in other places.

This type of FDI is common in hotels, food chains, shops, banks, and telecom companies.

Real-world example:

A hotel chain that is already doing well in its own country opens the same brand hotel in Nepal for both tourists and local people.

Why companies choose horizontal FDI:

- Faster market expansion

- Strong brand visibility

- Familiar business operations

Recommended Read: How to Choose Right Business Consultant in Nepal?

Vertical FDI

Vertical FDI focuses on different steps of the supply chain instead of selling the same final product in a new country. Companies use this type to spend less money, secure materials, or manage distribution better.

Vertical FDI has two main types:

Backward Vertical FDI: This happens when a company invests in raw material suppliers or producers in another country.

Example: A food processing company invests in farms in another country so it can get raw materials cheaply and without delays.

Forward Vertical FDI: This happens when a company invests in sales, distribution, or logistics in another country.

Example: A manufacturing company opens its own store or distribution centre in another country instead of depending on local sellers.

Why companies choose vertical FDI:

- Better control over supply chains

- Lower production and transport costs

- Less dependence on outside suppliers

Conglomerate FDI

Conglomerate FDI happens when a company invests in a totally different business in another country. The new business has nothing to do with what the company normally does.

This type of FDI is rare and risky because the company enters a new industry and a new market at the same time.

Real-world example: A tech company investing in a hotel or farming business in another country.

Why companies choose conglomerate FDI:

- Business diversification

- Risk spread across industries

- Long-term portfolio growth

Recommended Read: Business Ideas in Nepal

Platform FDI

Platform FDI is an investment strategy mainly for exports. A company builds or sets up production in one country mostly to sell products to other countries, not to the local market.

This type of FDI is common in factories, assembly plants, and processing companies.

Real-world example: A manufacturing company builds a factory in Nepal to make products that will be exported to nearby or worldwide markets.

Why companies choose platform FDI:

- Lower production costs

- Access to regional trade routes

- Export incentives and trade benefits

International FDI Strategies for Global Expansion

International FDI strategies change based on how fast a company wants to enter a new market, how much control it needs, and how much risk it can take. Picking the right strategy helps balance growth, cost, and rules in other countries.

Greenfield Investment

Greenfield investment means starting a business from nothing in another country, which gives the investor full control of how the business runs and grows.

Key features of greenfield investment:

- Build the business from scratch: The company creates new buildings, systems, and teams right from the start.

- Full ownership and control: The investor makes decisions without having to share power.

- Long-term focus: Made for steady growth over many years.

- High initial investment: Needs a lot of money to set up and start running.

Recommended Read: SWOT Analysis in Business

Mergers and Acquisitions (M&A)

Mergers and acquisitions (M&A) mean entering a foreign market by buying or joining with a company that already exists there.

Key features of M&A FDI:

- Fast market entry: The company can start working quickly using what is already built.

- Existing infrastructure and staff: The company gets buildings, workers, and customers right away.

- Integration challenges: Differences in culture, systems, or management need to fit together.

Joint Ventures and Strategic Partnerships

Joint Venture FDI is a strategy where a company shares ownership and operations with a local or foreign partner. This approach lowers risk, helps understand the local market, and makes it easier to follow rules, especially in new or regulated markets.

Key features of joint venture FDI:

- Shared ownership and risk: Partners split the money, decisions, and responsibilities.

- Local expertise: Partners bring local knowledge and business contacts.

- Easier regulatory compliance: Local partners help deal with laws and approvals.

Localization Strategy

Localization Strategy focuses on adapting the business to fit the needs and habits of the local market.

Key features of a localization strategy:

- Products and services: Offers are changed to match what local customers want.

- Pricing: Prices fit local income levels and competition.

- Marketing style: Ads match local language, culture, and values.

- Workplace culture: Management follows local work rules and behavior.

Recommended Read: Top Challenges SME Faces in Nepal

FDI Strategy in Nepal

Nepal is slowly becoming a practical place for long-term foreign investment because of its natural resources, location, and better investment rules, especially in infrastructure and energy.

Why Nepal Attracts FDI?

Nepal attracts foreign investors because it offers long-term opportunities in energy, infrastructure, and services, supported by better policies and access to nearby markets.

Key advantages of investing in Nepal:

- Strategic location: Nepal is between major Asian markets, making trade and regional access easier.

- Rich hydropower resources: Strong potential for clean energy projects that can provide long-term returns.

- Growing domestic market: Urbanization is increasing demand for modern goods and services.

- Government policy support: The government is introducing better rules, benefits, and legal protections for investors.

Legal and Regulatory Framework

Nepal has laws that guide foreign investment and protect investors while staying in line with national development goals.

- FITTA 2019: Makes rules for foreign investment approval, technology transfer, and sending money back home.

- Industrial Enterprises Act 2020: Manages industry registration, types of industries, and incentives.

- Companies Act 2006: Controls company setup, ownership, and business rules.

- PPP & Investment Act 2019: Gives the legal base for public–private partnership projects.

If you are wondering how to handle all the legal activity, Don't worry, Milan Khatiwoda can help you guide for your FDI Journey.

Governing Authorities for FDI Approval

Different government offices handle FDI approval, rules, and the movement of foreign money in Nepal.

- Department of Industry: Looks after FDI approval and registration for most projects.

- Investment Board Nepal: Approves and manages large or important investment projects.

- Nepal Rastra Bank: Manages foreign currency flow, loans, and sending profits out of Nepal.

Investment Requirements and Benefits

Nepal has certain requirements for entering the market along with benefits that grow investor confidence.

- Minimum investment: NPR 20 million – The minimum amount foreign investors must invest in Nepal.

- Fast-track or automatic approval routes – Some sectors get quicker approvals.

- Profit and capital repatriation rights – Investors have the right to send profits and capital back home legally.

- Legal protection for investors – Laws protect foreign investments from unfair treatment.

Sector-Wise Opportunities

Nepal focuses on FDI in areas that support long-term growth and national development.

- Hydropower and renewable energy: Big potential because of rivers and demand for clean energy.

- Transportation infrastructure: Chances in roads, airports, and logistics.

- Agriculture and food processing: Space for value addition, exports, and agro-businesses.

- Tourism and ICT: Rising demand for hotels, digital services, and technology.

- Some industries are restricted under Nepal’s negative list to protect national interests.

Recommended Read: Business Strategy Every Nepali Company Should Know

Step-by-Step FDI Establishment Process in Nepal

Starting Foreign Direct Investment in Nepal follows a proper legal order. Investors must complete each step to get smooth approval and follow rules.

- Step 1: Obtain FDI Approval (DOI or IBN) – You must apply for FDI approval from the Department of Industry (DOI) or Investment Board Nepal (IBN), depending on the size and sector of the project.

- Step 2: Company Incorporation at OCR – Then you need to register the company at the Office of the Company Registrar (OCR) to officially set up the business in Nepal.

- Step 3: PAN/VAT and Local Registration – After that, you must get PAN or VAT registration and finish local registrations to meet tax and operation needs.

- Step 4: Industry Registration at DOI – You need to register the business as an industry with the Department of Industry, which allows the business to operate formally.

- Step 5: NRB Approval for Foreign Fund Inflow – Then you must get approval from Nepal Rastra Bank (NRB) to legally bring foreign money into Nepal through banks.

Final Thoughts

Having a clear FDI strategy is really important for making smart and long-term investment choices in other countries. It helps investors manage risks, follow the rules, and match their business goals with the actual market.

By picking the right type of investment and plan, companies can build stable operations and grow over time. Successful FDI depends on choosing the right sector, understanding the laws and rules, and carefully completing the approval process.

Sectors like energy, infrastructure, farming, tourism, and ICT have strong long-term potential. With good planning and knowledge of the local market, Nepal can be a great place for foreign direct investment. Consult with Milan Khatiwoda for guidance.

FAQ Section

The main goal of an FDI strategy is to help a business enter a foreign market in a steady, long-term way. It makes sure investment choices match business goals, how much risk the company can handle, and local market conditions. A strong strategy also helps investors avoid legal problems and expensive mistakes.

FDI means owning part of a business, having control, and being actively involved in how it runs. FPI, on the other hand, is just putting money into shares or bonds without control. FDI focuses on long-term growth, while FPI focuses on short-term profits.

The main types of FDI are horizontal, vertical, conglomerate, and platform FDI. Each type has a different goal, like entering new markets, managing the supply chain, spreading risk, or making goods for export. The right type depends on what the business wants to achieve.

Nepal has strong FDI opportunities in hydropower, renewable energy, infrastructure, farming, tourism, and ICT. These sectors benefit from natural resources, growing demand, and government support. Investors usually prefer sectors that match long-term national development goals.

The FDI approval process starts by getting permission from the Department of Industry or Investment Board Nepal, depending on the project size. After that, investors need to register the company, complete tax and industry registration, and get approval from the central bank to bring in foreign money. Following the steps in order is important to avoid delays.